Term Life SafeGuard

132 million Americans -- 40% of the U.S. population --

rely on life insurance to protect their financial security.1

Product Information

Budget-friendly life insurance coverage for a select number of years.

Term Life SafeGuard

offers budget-friendly life insurance coverage for a select number of years to

help your clients' loved ones through a time of loss or critical

illness.

|

5 Benefit Levels:

$30,0002 • $25,000 • $50,000

• $75,000 • $100,000

|

|

Optional Critical Illness Benefit

5 Benefit

Amount Options:

$15,000 • $25,000 • $50,000 • $75,000 •

$100,000

|

|

2 Policy

Lengths:

10 year (issue age 18-59) or 20 year

(issue age 18-49)

|

The

Critical Illness cash benefit can be used to help with expenses like time away

from work, child care, household expenses and bills, and transportation/lodging

to seek treatment. The benefits paid from the Critical Illness benefit are

deducted from the Term Life benefit. |

|

1Facts

from Limra, September 2015

2In Illinois, the Term Life benefit must be

double the Critical Illness benefit.

|

|

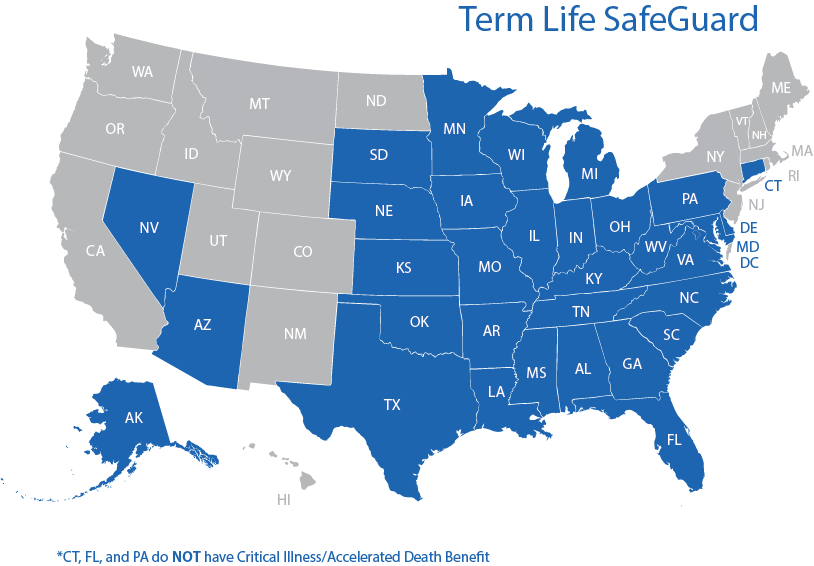

| Product Availability by

State |

|

|

Watch a brief

video to learn more about Term Life

SafeGuard |

|

|

|

|

|

Let us be the secret to your success!

Start here with these sales tips to help you with

your next client quote.

Sales Tips

We want you to be successful and feel prepared to present our product portfolio to your clients.

Use these Sales Tips to grow your Term Life business.

Target single income households and young families for Term Life insurance products. Both of these groups would be at risk if their primary source of income disappeared.

Has your client recently experienced a changing life event?

· Change in marital status

· Birth of a child / grandchild

· Home purchase

· Retirement

· Change in employment

These types of events often get people thinking about the security of their future.

Use this as an opportunity to introduce our budget-friendly Term Life insurance

products that require no medical exam.

When is the right time to offer a certain product?

How does it compare to other options?

We have the answers right here.

Product Positioning

We know your clients have a choice of products to meet their needs. That’s why we want to share a

few ways our Term Life SafeGuard product may be the best option for your client.

· Would your clients' families be financially secure in the event of their death? A Term Life

insurance plan can help ease the financial impact of a loss in the family.

· At the end of the initial policy term, Term Life policies can be renewed annually until the

insured's 75th birthday.

· No medical exams are required. Term Life SafeGuard products use simple underwriting

questions to determine your client's eligibility.

· Just 44% of U.S. households had life insurance in 2010. This opens you up to a lot of potential

clients with a need for life insurance!1 (Source - LIMRA's Trends in Life Insurance Ownership)

1LIMRA’s Trends in Life Insurance Ownership

Not for consumer use. Golden Rule Insurance Company is the underwriter and administrator of these plans.